The debit column of the general journal is used to record the amounts of the accounts that are debited while the credit column is used to record the amounts of the accounts that are credited. The entry made in the debit and credit columns states the dollar amounts that have been spent or that need to be transferred between accounts. In addition to the general journal, there are several special journals or subsidiary journals that are used to help divide and organize business transactions. The General Journal is a catch-all journal where transactions that don’t fit into special categories are recorded.

General Journal vs. General Ledger

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. One of the main advantages of using General Journal is that it provides an exact details about all transactions. It provides a place to take any kind of transaction, even Trial Balance. The two headings are, a) account headings column b) date of entries column.

Journal Process Flow:

Debit, which is abbreviated as Dr, refers to the left side of an account. In the example, the cash account was debited by recording the amount of the sale on the account’s left side, resulting to an increase in the balance of the account. If you do end up making an error, you can easily find it by adding both sides of your journal entry together. If they do not equal the same number, you know that something has gone wrong. Whenever an event or transaction occurs, it is recorded in a journal.

Journal Entry: Definition

There are many different journals that are used to track categories of transactions like the sales journal, all company transaction are recorded in the general journal. The general journal is the book that entity firstly records all of the daily financial transactions in it. It is also called a book of original entries because all of the transactions are records in this book before moving to other books.

Why You Can Trust Finance Strategists

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company. Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events.

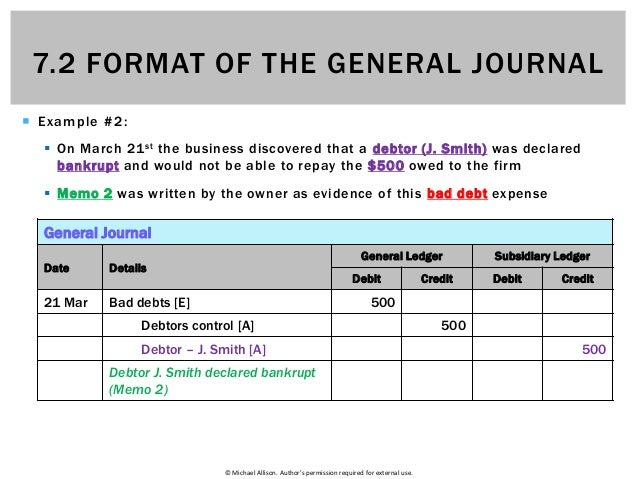

- All journal entries are posted periodically to the ledger accounts.

- In addition, they may also be used to show transactions that have been recorded in a general journal or some other type of specialized book of accounts.

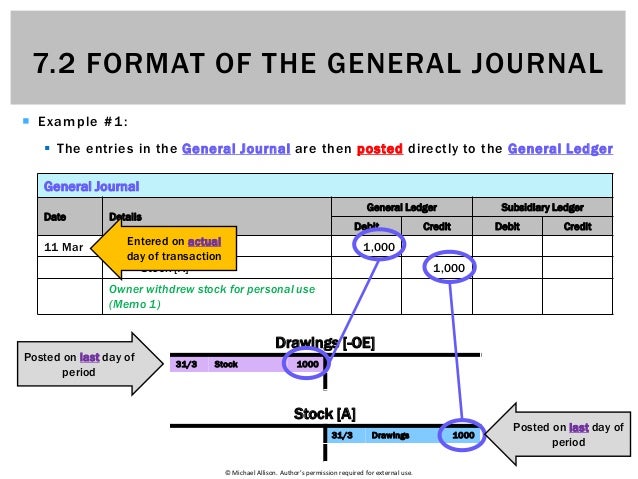

- Examples of transactions recorded in the general journal are asset sales, depreciation, interest income and interest expense, and stock sales and repurchases.

An individual trader or a professional fund manager can form a journal where he records the details of the trades made during the day. These records can be used for taxation, audit, and evaluation purposes. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

When using a special journal, only the total amounts of each column in the special journal is posted in the general ledger. This is similar to the posting process of using profitability index pi formula calculator a combination journal. A Special Journal is an accounting journal that contains records of high-volume business transactions that are repetitive and of the same nature.

Electronic spreadsheets and even cloud-based databases became mainstream while physical records were already considered a thing of the past. Expenses are increased in debit, so we need to debit the amount when we record it in the journal. If the entity pay by cash, then credits the same amount to cash.

These journals are the sales journal, cash receipts journal, purchases journal, and cash disbursements journal. Instead, by default, all remaining transactions are recorded in the general journal. Once entered, the general journal provides a chronological record of all non-specialized entries that would otherwise have been recorded in one of the specialty journals.

One person can specialize on sales journals while another can be responsible for the purchases journal. The journal contains the columns to accommodate the parts of the journal entry, i.e. transaction date, debit entry, credit entry, and transaction description. An additional column, the Post Reference, also called the Folio, indicates the ledger account where the entry will be posted. In summary, an accounting transaction is recorded into a journal, and then the information in the journal is posted into the accounts which are stored in the general ledger.

For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal. There are numerous other journals like the sales journal, purchases journal, and accounts receivable journal. These entries are made in the order that the transactions occurred. General journals typically contain information about things like cash receipts and payments. In addition, they can also contain inventory balances, purchases and sales.