“PHQ-9” indicates being at or above its clinical threshold of 10 out of a possible 27, reflective of having at least moderate depressive symptoms. Similarly, “GAD-7” indicates being at or above its clinical threshold of 10 out of a possible 21, reflective of having at least moderate symptoms of generalized anxiety. Probabilities taken from multivariable logistic regression with year fixed effects. Models employed a cluster-robust within-survey year estimator adjusted for individual characteristics.

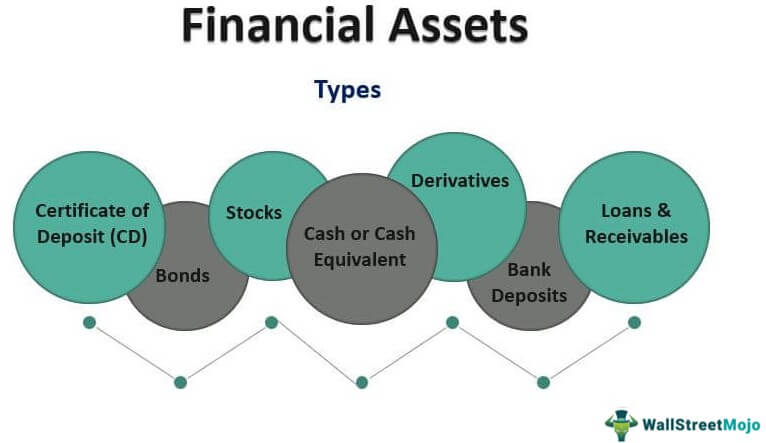

Understanding Financial Instruments

For financial assets to be measured at fair value through profit or loss by designation, designation is only possible at the amount the asset was initially recognized at. Moreover, designation is not possible for equity instruments which are not traded in an active market and the fair value of which cannot be reliably determined. Figure 1 shows the weighted regression adjusted prevalence of positive screening for depression and anxiety by accrued financial assets group.

Assets in Accounting and Business Operations

Our estimation approach was selected for its robustness to the incidental parameters problem (relative to a model including individual fixed effects) and because it has been well established in the literature50,51,52. Our adjustment variable selection was guided by prior literature demonstrating important confounders17, and empirically corroborated by LASSO regression. Overall, financial assets are useful when including high liquidity assets as part of your strategic investments plan. Several monetary instruments are considered liquid assets including cash, equity instrument, bonds, and receivables.

Derivative Instruments

- No matter how bad the economy is at a given time, companies that make products that are essential to everyday life will survive.

- Financial assets are a crucial component of an individual’s or organization’s wealth and investment portfolio.

- Investing in stocks of a company means participating in the company’s ownership and sharing its profits and losses.

- Unlike stocks, pooled investment vehicles represent an investment in many different stocks instead of just one holding.

Liquid assets are things of economic value that can be quickly and easily converted to money. Liquid personal assets might include certain stocks, and liquid business assets could include inventory. Fixed assets are resources with a longer term, meaning more than a year. This includes property, like buildings and other real estate, and equipment. Certain financial assets like treasury bills are considered near-cash due to their high liquidity and short maturities.

The underlying assets in an aggressive portfolio generally would assume great risks in search of great returns. Aggressive investors seek out companies that are in the early stages of their growth and have a unique value proposition. Moreover, budding entrepreneurs can meet their financial goals with the forex funding facility of this business banking suite. This facility is led by an expert team of forex who offers correct information related to forex rates, current RBI guidelines, etc.

Financial Assets vs. Real Assets vs. Intangible Assets

Conducted data analysis, interpreted data, and drafted the manuscript. S.M.A. supported acquisition of the data through funding and reviewed the draft manuscript. M.K.M. contributed to analysis strategy, interpreted the data, and reviewed the draft manuscript. Acquired the data, interpreted the data and reviewed the manuscript. You can buy and sell cryptocurrencies through a crypto exchange, such as Gemini or Coinbase. As the company grows and earns greater profits, the value of your shares of stock should appreciate.

It will be constituted as real assets; whereas the total bank balance reflected in the mobile application of the bank will act as intangible assets. On the other hand, the value of this financial asset increases or decreases based on the ownership or claims. It is a pool of money collected from many individual investors and companies to invest in various types of assets. A professional portfolio manager is hired to invest the capital in a portfolio of securities. In the end, any gains are passed down to investors on a pro-rata basis.

In exchange, the insurance company agrees to make periodic payments to you for a set period. Many people typically use annuities to get a steady stream of income in retirement. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score.

If for example, someone is saving for a wedding or another shorter-term financial goal, they may want to keep a percentage of that money in a safe, easy-to-access account, such as a high-yield online deposit account. An account like this would allow that money to grow with a competitive interest rate while it’s protected from the market’s unpredictable movements. As noted, assets how to prepare an income statement can run the gamut from the physical to the intangible. There are different methods for determining value, such as the cost method, which bases an asset’s value on its original price. That’s when an accounting method known as depreciation is used to allocate the cost of an asset over time. Foreign exchange instruments comprise a third, unique type of financial instrument.