If, however, it falls short of the actual overhead, the difference is known as under-applied overhead. This ensures that the cost pertaining to a cost center must be absorbed as per the set norms. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

Machine Hour Rate

Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level. This can complicate operational decision-making, activity based costing vs traditional steps results compared particularly in industries where cost control and pricing flexibility are crucial for competitiveness. Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines.

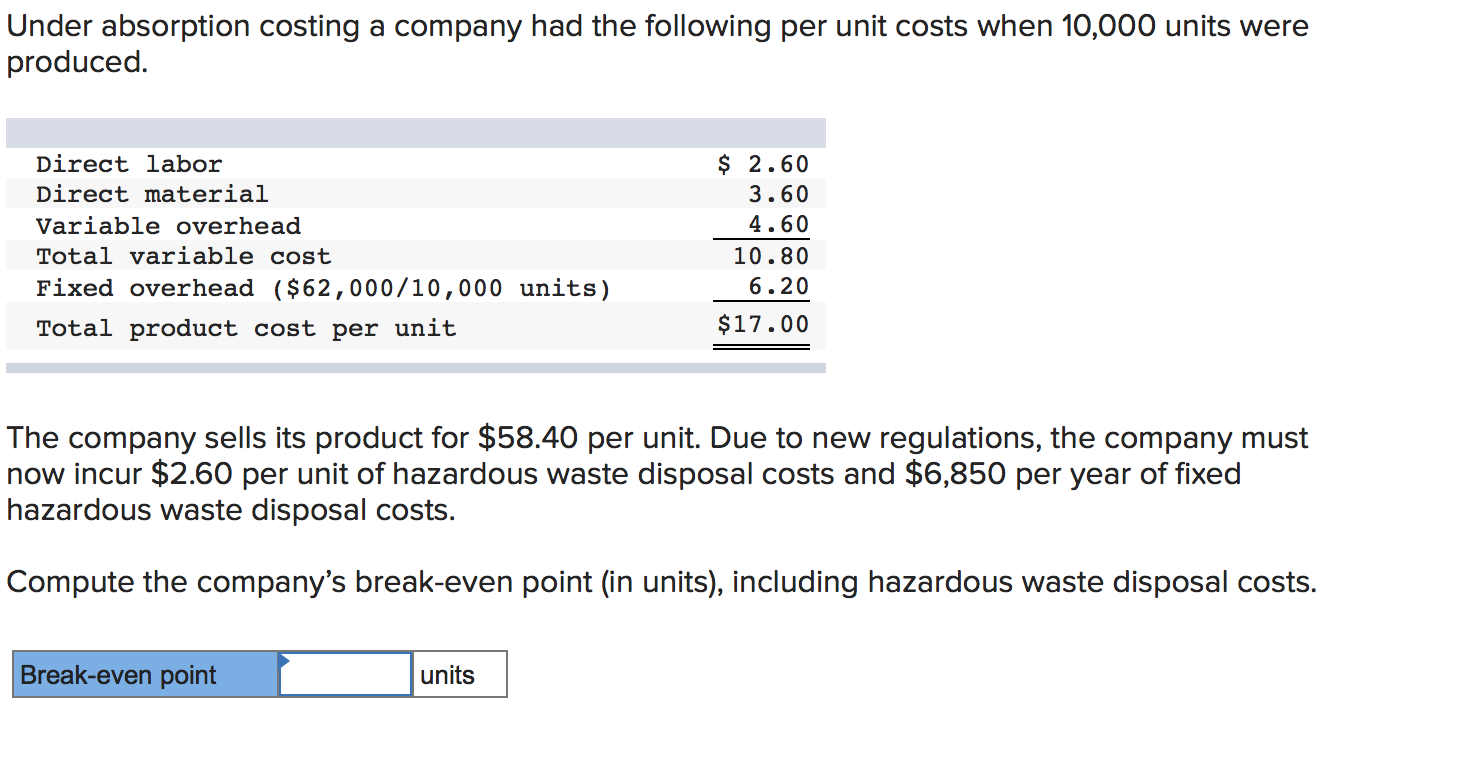

- It can be more useful, especially for management decision-making concerning break-even analysis to derive the number of product units that must be sold to reach profitability.

- Absorption Costing can provide a complete picture of the financial cost calculation.

- The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit.

- General or common overhead costs like rent, heating, electricity are incurred as a whole item by the company are called Fixed Manufacturing Overhead.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- If the absorbed amount exceeds the actual overhead, the difference is termed overapplied overhead.

Calculating Absorption Cost For Manufacturing Businesses

Therefore, direct costing is not acceptable for external financial and income tax accounting, but it can be valuable for managing the company. Because absorption costing includes fixed overhead costs in the cost of its products, it is unfavorable compared with variable costing when management is making internal incremental pricing decisions. This is because variable costing will only include the extra costs of producing the next incremental unit of a product. It can make a big impact on the per-unit price if a company has high direct, fixed overhead costs. Companies that use variable costing may be able to allocate high monthly direct, fixed costs to operating expenses. Most companies may have to transition to absorption costing at some point, however, and it can be important to factor this into short-term and long-term decision-making.

What is overhead absorption?

The product of this calculation will indicate the amount of overhead to be applied (or charged) to production for the period. This method is suitable for labor-intensive industries in which manual labor is a dominant factor in production. All products, jobs, or services pass through one or more producing cost centers. This involves taking each cost center and applying its overheads to all the products that pass through it. Therefore, fixed overhead will be allocated by $ 1.50 per working hour ($ 670,000/(300,000h+150,000h)).

This method of costing is essential as per the accounting standards to produce an inventory valuation captured in an organization’s balance sheet. As a general rule, relate the difference in netincome under absorption costing and variable costing to the changein inventories. Conversely, ifinventories decreased, then sales exceeded production, and incomebefore income taxes is larger under variable costing than underabsorption costing.

To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Generally accepted accounting principles only require absorption costing for external reporting, not internal reporting. External reports are generated for public consumption; in the case of publicly traded corporations, shareholders interact with external reports. Looking at the above mentioned example, Absorption Costing could be required to determine the overhead costs of the enterprise. The more items one plant can produce, the lower the costs will be of these items, especially the overhead costs. If the factory starts producing other items or products, it is possible to spread and reduce the overhead costs even further.

It is very important to understand the concept of the AC formula because it helps a company determine the contribution margin of a product, which eventually helps in the break-even analysis. The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit. Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost. Both costing methods can be used by management to make manufacturing decisions. Both can also be used for internal accounting purposes to value work in progress and finished inventory.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. It gives reasonably accurate results when the quality and prices of raw materials do not differ substantially. This application of overheads is called absorption, which can be defined as the charging of overheads to production.

Inventory valuation is a critical aspect of absorption costing, as it determines the cost of unsold inventory and cost of goods sold. Under this method, both fixed and variable manufacturing costs are included in the valuation of ending inventory on the balance sheet. Consequently, unsold inventory carries a portion of the fixed costs, which are not expensed in the income statement until the inventory is sold. This can lead to a situation where reported profits are higher in periods of increasing inventory levels, as some of the fixed costs are deferred to future periods.