Hard Money Financing Possibilities (855)-244-2220

Taking old-fashioned home loan items having rehabbing qualities are tough. Aside from the enormous borrowing from the bank requirements and you can paperwork, you have got to read a time-sapping and you will demanding evaluation techniques. Difficult currency treatment funds can save you the situation while you are selecting quick and a fantastic read you can efficient resource paths.

Whether we would like to rehabilitate a house for your self or flip it getting money, being well-informed with the difficult money financing activities allows you to browse the fresh new world with full confidence. I have built this informative guide to go over:

- All round viability away from hard money financing

- Qualification and you may evaluating facets

- Particular risk what to be cautious about

Rehabilitation Borrowing-A fast Summary

Old-fashioned home loan products are enough time-title and you may geared towards providing homebuyers which have a comfortable substitute for pay the borrowed funds when you look at the 15 to help you 30 years. You will want to installed a tiny share (10%30%) towards a down-payment, and you are clearly happy to buy the domestic and you will move around in.

Rehabilitation funds is actually a tad bit more challenging than just regular lenders since the possessions isn’t really livable but really. You have got to throw-in a critical contribution into the solutions and you can wait a different sort of step 3fifteen weeks towards the family to get able. Such as the case of build financing, the latest property’s recoverable worth is upwards in the air up until the project is accomplished, and that entails increased financing risk.

Treatment funds are considered advanced level economic systems, and additionally they make a lot more feel than just mortgage brokers in many facts. The merchandise ‘s the go-to option for possessions flippers otherwise buyers seeking developed accommodations device as they usually do not qualify for thinking-occupied mortgage loans. Property owners on a tight budget plus prefer treatment loans to own updating its latest family otherwise purchasing a new you to definitely due to the lowest downpayment responsibility.

Opting for a loan provider getting rehabbing try problematic because you you desire some body understanding and flexible, and you will big-title financial institutions may not be up for the task. This is when difficult currency loan providers are able to stick out!

Why Hard Money Treatment Money Operate better Than simply Conventional Financing

An everyday treatment loan are short-label features a higher interest than just generic home loan pricing, regardless of the bank you run. So, more than the fresh costs, this is the pursuing the six items that make hard currency rehabbing packages a customer favourite:

- Simple certification standards-Qualifying having rehabbing bundles with finance companies is actually excruciating by the bureaucracy working in particularly circumstances. Tough money funds try advantage-recognized plus don’t involve excessively compliance, therefore the lenders dont look excessive into the credit ratings and you may individual finances to own risk mitigation

- Convenience-Users like hard currency-allowed rehabbing on account of limited paperwork conditions and you can quick control

- Speed-Application screening getting bank-funded rehab applications, such a national Construction Management (FHA) 203(k) otherwise a fannie mae HomeStyle Recovery financing, persists around 3 months. New wait going back to delivering tough money financing are 23 months

- Command over money-Finance companies transfer the new treatment finance to help you an enthusiastic escrow account and make transmits towards the company occasionally. Tough currency loan providers usually import the cash directly to consumers, which means you have the flexibility so you can carry out DIYs in the place of choosing builders

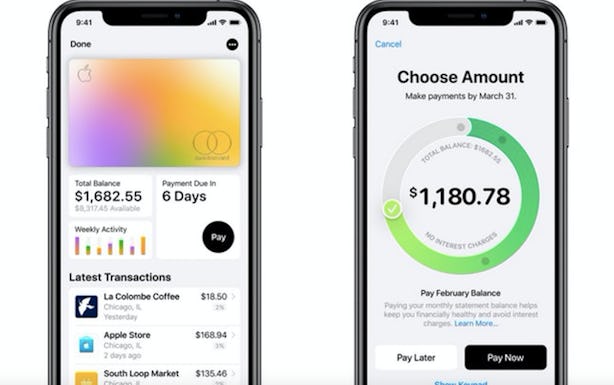

- Instant rates union-Traditional rehab money need to have the borrower to offer the down currency to the escrow account in addition to the closing costs. The immediate cash outflow is a lot down that have tough currency rehab issues. You don’t have to make surprise advance payment, as well as the settlement costs are due at the conclusion of the tenure

- Less restrictions-In the place of financial institutions, hard money loan providers would not determine qualified and you may ineligible solutions. They also don’t care about exactly how many construction units you possess or if you will be with them in order to assists financing, rental, or providers wants, enabling property flippers for increased level of treatment strategies