Adjustment entries can also impact a business’s stock-based compensation expenses. Adjustment entries can impact a business’s cash flow by affecting the timing of cash inflows and outflows. For example, if an adjustment entry is made to increase accounts receivable, this will increase the amount of cash that the business expects to receive in the future. On the other hand, if an adjustment entry is made to increase accounts payable, this will decrease the amount of cash that the business expects to pay in the future. The adjustment entry is then recorded in the general ledger using the appropriate accounts and amounts. The bookkeeper or accountant must ensure that the adjustment is recorded correctly as a debit or credit to the appropriate account, depending on the nature of the adjustment.

Accounting Periods

Amortization is a technique used in accounting to spread the cost of an intangible asset or a loan over a period. In the case of intangible assets, it is similar to depreciation for tangible assets. The accumulated amortization account will have a total balance of 50,000 after 5 years of amortization. This balance represents the total amount of the intangible asset that has been expensed. Eventually, the intangible asset will have zero remaining cost, meaning it’s fully amortized. Prepaid insurance is insurance that has been paid for but not yet used.

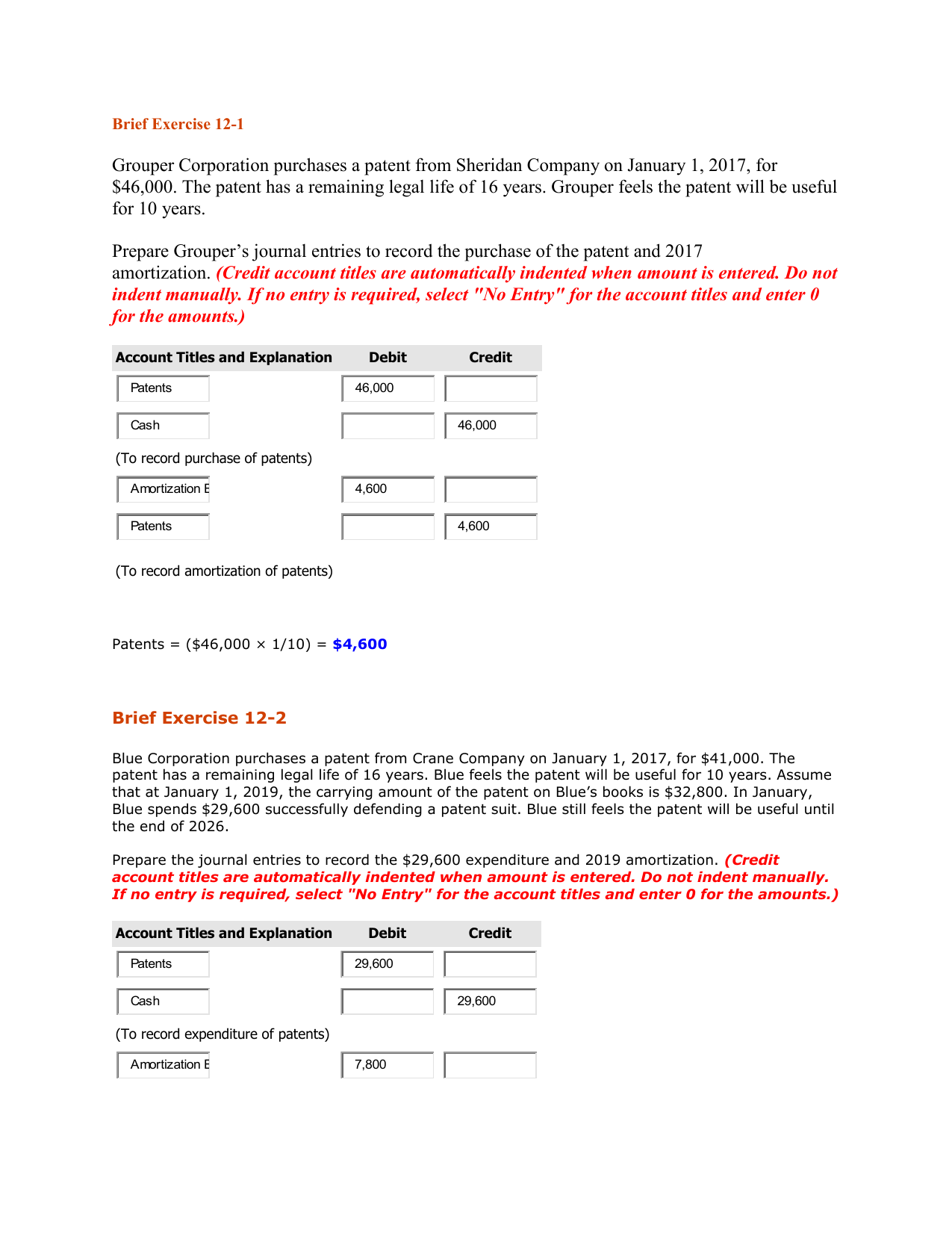

Journal Entry for Amortization of Patent

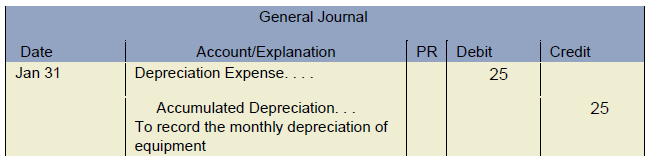

These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year. To record a prepaid expense, an accountant would debit an asset account and credit a liability account. Amortization is the process of spreading out an intangible asset’s cost over a certain period of time in accounting. This paints a more realistic picture of your company’s health and helps to level out your tax liabilities throughout the useful life of intangibles. The journal entry of amortization expense will debit the expense and credit the accumulated amortization.

The Role of Adjustment Entries in Financial Statements

- On the client’s income statement, it records an asset of $100,000 for the patent.

- This has a myriad of benefits, including relevant financial reports that help investors, owners and other stakeholders make effective economic decisions.

- Understanding adjustment entries is critical for anyone involved in accounting, finance, or business operations.

- Adjusting entries are necessary to ensure that financial statements accurately reflect a company’s financial position.

That being said, the way this amortization method works is the intangible amortization amount is charged to the company’s income statement all at once. The amortization of loans is the process of paying down the debt over time in regular installment payments of interest and principal. An amortization schedule is a table or chart that outlines both loan and payment information for reducing a term loan (i.e., mortgage loan, personal loan, car loan, etc.).

Unearned Revenues

Without adjusting entries, financial statements may be misleading and inaccurate. Adjustment entries are accounting entries made at the end of an accounting period to record transactions that have occurred but have not yet been recorded. These entries are necessary to ensure that financial statements accurately reflect the company’s financial position and performance. These entries impact both the income statement and balance sheet by reducing net income while also reducing asset values over time. You must record amortization expenses in your accounting books. To do so, debit the amortization expense account and credit the intangible asset.

Intangible assets

These entries are made at the end of an accounting period to adjust the accounts to their correct balances. You debit your amortization expense account because it is an expense. You credit your intangible asset account because it is an asset. When you amortize intangible assets, you must include the amortized amount on your income statement. Moreover, on the balance sheet, accumulated depreciation and amortization are subtracted from their respective asset accounts to determine their net book value. This adjustment reflects how much of an asset’s initial cost has been allocated over time.

The journal entry for amortization expense involves debiting the Amortization Expense account and crediting either an Accumulated Amortization or a Contra-Asset account. This allows for proper tracking and gradual reduction of the asset’s value over time. Journal entries are an essential part of accounting, as they help record the financial transactions of a business accurately. When it comes to amortization expense, there are specific journal entries that need to be made.

Sum-of-the-years digit amortization follows a curved pattern of cost distribution that increases over time. Turn to Thomson Reuters to get expert guidance on amortization and other cost recovery issues so your firm can serve business clients more efficiently and with ease of mind. By leveraging Thomson Reuters Fixed Assets CS®, firms can effectively manage assets with unlimited depreciation treatments, customized reporting, and more. A business client develops a product it intends to sell and purchases a patent for the invention for $100,000. On the client’s income statement, it records an asset of $100,000 for the patent.

Because they are reporting it in the annual report, we can assume they are using separate GL accounts for the accumulated amortization. However, like other which journal entry records the amortization of an expense assets, patents also lose their value over time as they can be obsolete, expire, etc. To reflect this decrease in value, firms amortize their patents.