You will be regularly each other borrowing unions and you may banks, however, actually ask yourself how they it really is change from both? Credit unions and you can financial institutions is each other help you unlock accounts, save money, and you will reach finally your monetary arrangements. But keep reading examine the key differences between credit unions and you can financial institutions, and you will what type might possibly be your best choice.

Banks & Borrowing Unions: Their Goal

The main difference between a bank and you can a cards relationship is you to a bank was an as-profit standard bank, while a card connection is not-for-funds. Thus, banks is actually motivated mainly while making winnings because of their shareholders.

In addition, borrowing unions like APGFCU, try cooperatives. It indicates they are belonging to its account holders (also known as users), with a common objective from the businesses achievement.

Instead of paying back profits to shareholders such as for example banking institutions manage, credit unions pass along income to users when it comes to highest dividends toward places, down and you may less charge, and you may significantly lower rates on the finance and you may handmade cards. Along with, users can weigh-in toward extremely important decisions you to contour the future of the borrowing relationship.

Just like the a no more-for-profit, APGFCU is here to a target you. Professionals have access to services and products to greatly help fulfill all of the of their financial demands, like to order property, strengthening a corporate, and preserving for future years.

Member-Centric Focus

In the credit unions, your own voice things. No matter what much currency you really have into the put, per member possess an equal choose inside the electing the fresh new voluntary board users toward company. While the a part, the best interests book the device we offer and every choice i build.

Due to the fact maybe not-for-cash groups, credit unions’ done appeal would go to enabling their members achieve monetary fitness. On getting-money loan providers, your elizabeth fancy or value to be a card connection associate-holder loans in Babbie without credit check.

Product Diversity

Borrowing unions pleasure on their own over the top-level customer service, troubled to provide private awareness of for each and every associate and delivering high worry to ensure satisfaction. Of several, such APGFCU, also have totally free info when it comes to financial training coating different topics for your monetary really-getting.

Competitive Rates & Reasonable Charges

Finance companies and you can borrowing from the bank unions both make money from lending money in the high rates of interest than it pay out to the deposits, and you can through fees.

Yet not, borrowing from the bank unions usually bring greatest rates and lower costs because notice is on going back payouts so you’re able to professionals, in lieu of outside buyers. 1 Becoming maybe not-for-money tends to make credit unions exempt out-of a number of the fees banks have to pay. dos

Safeguards regarding Banks & Borrowing Unions

Both banks and you can borrowing from the bank unions provide the same degrees of put insurance policies to $250,000, secured and you may supported by the government. step 3 Financial institutions is actually insured because of the Federal Deposit Insurance coverage Agency (FDIC). Credit unions fall under the Federal Borrowing Relationship Government (NCUA), which is comparable to new FDIC getting banking institutions.

With pride Regional, Just like you!

Credit unions are typically worried about the city in which they reside. The reason being borrowing unions share a familiar bond having subscription, like traditions otherwise doing work in a similar area. Borrowing unions play a crucial role in improving the top-notch lives inside their communities of the just delivering extremely important money also positively stepping into volunteerism, exemplifying the dedication to making the places they serve most useful and you can a great deal more durable.

APGFCU together with enjoys planned the brand new youngest society people by providing childhood subscription coupons is the reason ages delivery so you’re able to 18, with positives moving on because participants grow.

The best objective is to improve the lifestyle of all some one on the people. As an example, mouse click less than to read on APGFCU’s donation that served the building out-of a different basketball cutting-edge to own in a different way abled college students inside Harford County.

This informative article could have been delivered to academic motives simply which can be maybe not intended to change the recommendations away from a loan affiliate or financial advisor. The fresh new examples offered inside article are to possess instances merely and you will might not affect your role. Given that most of the situation is different, we advice speaking-to that loan affiliate otherwise monetary advisor regarding your unique demands.

- APGFCU 2024

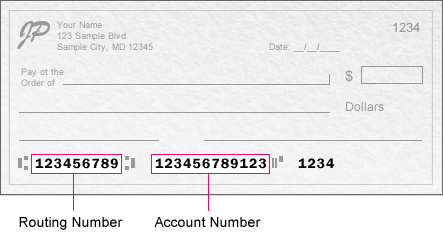

- Navigation Number 255075576

- APGFCU PO Field 1176, Aberdeen, MD 21001-6176

- Phone: 800-225-2555

- APGFCU NMLS # 480340APGFCU NMLS Registry Quantity

When you use a display viewer and generally are having trouble using this type of web site excite fool around with our usage of contact form or phone call 410-272-4000 otherwise cost-totally free on 800-225-2555 getting direction.