Furthermore, a keen SBC loan is actually an investment property financing shielded from the a great commercial resource. Why don’t we consider some other parallels and you may variations.

Individual loan providers generally speaking lookup generally in the cash flow to possess residential and you may industrial mortgage loans. Whenever you are a good credit score is highly extremely important, the main grounds is having a personal debt-Solution Publicity Ratio (DSCR) you to definitely reveals the latest borrower’s capability to pay new loanmercial real estate money have only far more difficulty than just residential mortgages.

Such as for instance, getting industrial functions, brand new underwriter are considering multiple leases in the place of one to. It is very tough to assess the financial reputation commercial renters, thus loan providers often opinion the latest lease records as an alternative.

Whenever using antique lenders instead of individual lenders , commercial a house fund end up being way more nuanced. Financial institutions need much higher reserves and far significantly more documents.

Both form of functions require earliest mortgage data files, also a personal be certain that, book paperwork, and you may entity documents. A commercial financing will demand then files, with regards to the brand of property. Examples include occupant estoppels, non-interference plans, or lockbox agreements.

Visio Financing allows short-to-medium traders to enhance their portfolios off leasing features, including vacation rentals. Our DSCR Money try underwritten playing with assets top cashflow, in place of individual income. We are happy giving:

Industrial Home loan Criteria

In advance of investigating industrial a house finance, you need to pick which kind of home you want to buy, that commonly impression what type of mortgage your follow. Having financial support qualities, good DSCR loan was a better choices than many other industrial credit possibilities, because has the benefit of an easy mortgage recognition procedure, limited individual loans study, less strict mortgage conditions , and you may a wise practice credit fine print.

Credit score

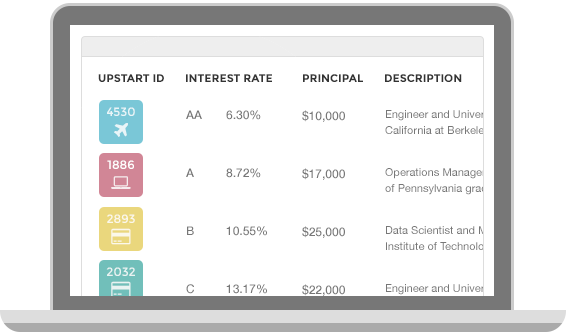

Most industrial lenders, along with Visio Credit, want a credit score with a minimum of 680, however, this may differ according to the lender’s stipulations. Generally, high credit ratings offer you most readily useful cost. The greater their score, the fresh nearer your own genuine interest would be to the prime rates which is afforded into the most well-licensed borrower.

One benefit from seeking a DSCR mortgage is the fact there can be shorter studies into your credit score before credit approval, which makes it easier to possess mind-functioning consumers compared to conventional financial station. DSCR fund also are good for minimal partnerships given that, instead of really finance, you could potentially use as the a corporate organization rather than just one.

Advance payment

For industrial a home money, need installment loans online Georgia that loan-to-well worth proportion out-of 80% or down, which means that just be sure to provide an advance payment of at least 20%. Visio Credit need an LTV as high as 80%.

Property value and you will Amount borrowed

Normally, the minimum value of is actually $150,000. With respect to the borrowed funds amount, the smallest commercial loan you can basically accessibility are $75,000. The most amount borrowed depends upon the fresh property’s variety of, estimated cashflow, the fresh LTV, or other criteria.

How to Get a professional Home loan

After you have confidence in Visio Financing having a professional financing, your take advantage of a streamlined techniques, aggressive rates of interest, and you can wisdom borrowing from the bank protocols that permit you expand your collection quickly. Is an instant review of what you are able predict after you like united states as your commercial home mortgage financial.

Because you begin the method having a professional mortgage, just take stock of your financial predicament, such as your credit rating, bucks supplies, and you may monthly cash flow, to understand exactly how much you really can afford.

Making use of the home loan calculator predicated on most recent rates plus the mortgage count you’re considering, you can see when you find yourself going regarding best guidance inside the reference to payment per month models. Be sure to cause for closing costs therefore the down-payment in relation to the initial costs. This can help you see how far you can afford, which will surely help you restrict your own real estate possibilities.

Set Needs

Now that you understand the loan amount you have access to, it is the right time to remark current property that may work for you. Manage an experienced industrial real estate professional to get services that suit their requisite based on dimensions, area, and you will local rental money, following play with all of our rental money calculators to ascertain exactly how lucrative the choices are.

You may want to explore Visio Lending’s DSCR calculator , that’ll leave you a straightforward ratio that shows how good the home will cover the bills, such as for example mortgage repayments and you will repairs. These power tools was a critical an element of the exploration techniques prior to your approach lenders.

Start the program Techniques

When you’ve known good assets and you may ascertained your own creditworthiness getting financing, you can start preparing their files. To possess a DSCR mortgage, you do not have private loans suggestions particularly tax returns, pay stubs, or financial statements: the we require when it comes to your monetary products is your credit score.

The paperwork a corporate has to rating a beneficial DSCR loan is related to the property, instance rent agreements and you can an appraisal, which shows whether it’s and make adequate money to invest in the brand new financing. You might remark the records we need toward all of our FAQ.

You’ll then finish the software and you may fill in the required paperwork. All of our procedure is fast: you can buy acceptance in 21 days or smaller, that will help you stand aggressive in the industry. In the meantime, you need to very carefully opinion every mortgage words, such as for example regarding the amortization period.

In lieu of home loans, DSCR fund keeps prepayment penalties: because of this if you pay the loan early, you will need to shell out a percentage of the loan amount together with their percentage. That it ensures the lending company normally recover the increased loss of funds it could have made from the pace on your own costs.