If quality assets have been depreciated faster than the drop in their true market value, you’ve found a hidden value that may help hold up the stock price in the future. If assets are being depreciated slower than the drop in market value, then the book value will be above the true value, creating a value trap for investors who only glance at the P/B ratio. Earnings, debt, and assets are the building blocks of any public company’s financial statements.

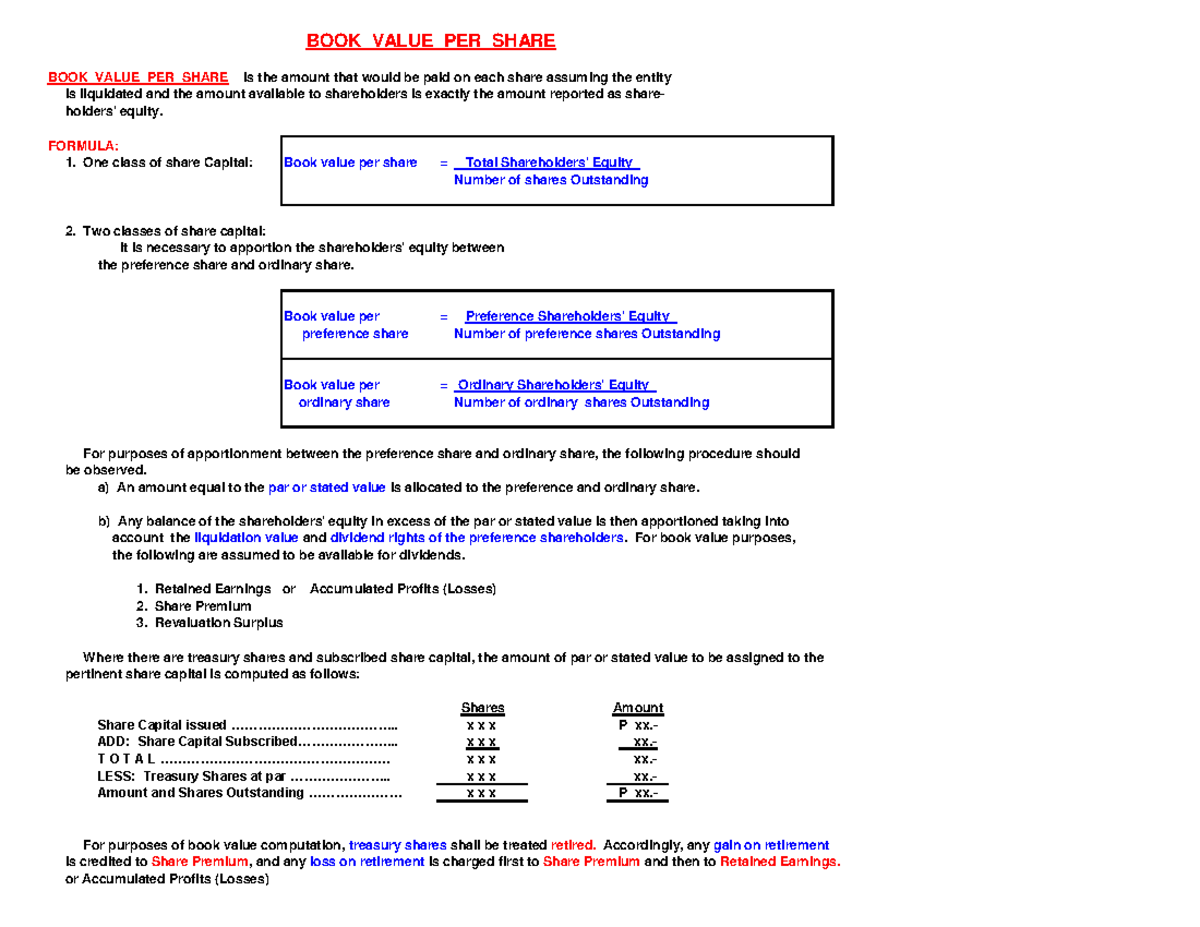

How to Calculate Book Value Per Share

In those cases, the market sees no reason to value a company differently from its assets. If XYZ Company trades at $25 per share and has 1 million shares outstanding, its market value is $25 million. Financial analysts, reporters, and investors usually mean market value when they mention a company’s value. Book value does not always include the full impact of claims on assets and the costs of selling them. Book valuation might be too high if the company is a bankruptcy candidate and has liens against its assets.

Why is BVPS important for value investors?

To better understand book value per share, it helps to break down each aspect of the ratio. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. The book value per share is just one metric that you should look at when considering an investment. It’s important to remember that the book value per share is not the only metric that you should consider when making an investment decision. If a company is selling 15% below book value, but it takes several years for the price to catch up, then you might have been better off with a 5% bond. For asset-heavy industries, BVPS might provide a reasonable estimate of value.

Market Capitalisation = Market Value of a Stock x Number of Outstanding Shares

Comparing BVPS to the market price of a stock is known as the market-to-book ratio, or the price-to-book ratio. It is strictly a measure of the company’s balance sheet values as of a point in time. An asset’s book value is the carrying value of that asset on the company’s balance sheet. Carrying value is the asset’s original cost less any accumulated depreciation or amortization. Accumulated depreciation is the aggregate depreciation recorded against that asset during its lifetime. Some happen naturally as the result of company growth; others are specific actions a company might use to tighten up its financial position.

What Book Value Means to Investors

Now, let’s say that Company B has $8 million in stockholders’ equity and 1,000,000 outstanding shares. Using the same share basis formula, we can calculate the book value per share of Company B. The Book Value Per Share provides information about how the value of a company’s stock compares to the current Market Value Per Share (MVPS), or current stock price. For example, if the BVPS is greater than the MVPS, the company’s stock market may be undervaluing a company’s stock. Book Value Per Share is calculated by dividing the total common equity by the number of outstanding shares. Price-to-book (P/B) ratio as a valuation multiple is useful when comparing similar companies within the same industry that follow a uniform accounting method for asset valuation.

It’s also a useful measure to compare a company with a lot of goodwill on the balance sheet to one without goodwill. Calculate BVPS for any stocks you own, and you’ll see it can be wildly different from the company’s share price. This is because the share price is a demand-driven value that’s influenced by the investment community’s opinion on the company’s earnings potential.

Value investors actively seek out companies with their market values below their book valuations. They see it as a sign of undervaluation and hope market perceptions turn out to be incorrect. In this scenario, the market is giving investors an opportunity to buy a company for less than its stated net worth.

Book value per share is a way to measure the net asset value that investors get when they buy a share of stock. Investors can calculate book value per share by dividing the company’s book value by its number of shares outstanding. It is unusual for a company to trade at a market value that is lower than business succession planning its book valuation. When that happens, it usually indicates that the market has momentarily lost confidence in the company. It may be due to business problems, loss of critical lawsuits, or other random events. In other words, the market doesn’t believe that the company is worth the value on its books.

- Generally, the book value per share is used by investors (especially value investors) to determine whether a share is fairly valued.

- If the market price for a share is higher than the BVPS, then the stock may be seen as overvalued.

- In this case, the company’s price/BVPS multiple seems to have been sliding for several years.

- Minority interest is the ownership of less than 50 percent of a subsidiary’s equity by an investor or a company other than the parent company.

- Book Value Per Share solely includes common stockholders’ equity and does not include preferred stockholders’ equity.

Companies that store inventory in a warehouse can count all of that inventory toward their book value. However, tech companies that specialize in creating software don’t have an asset that is stored somewhere, and they don’t require expensive industrial equipment to produce their product. They may generate sales with that software, but there isn’t a warehouse full of software code that investors can look at to gauge future sales. For example, if the BVPS of ABC Company is $15 and its market value is $30, investors might conclude that the market overvalues the stock by 100%.